When it comes to investing, it’s important to understand how taxes will impact your returns. Qualified dividends and capital gains are taxed at lower rates than ordinary income, making them a popular choice for investors looking to maximize their profits. In 2024, the IRS has specific guidelines for calculating the tax on these types of income.

It’s essential to stay informed about the latest tax laws and regulations to ensure you are accurately reporting and paying taxes on your investment income. The Qualified Dividends and Capital Gain Tax Worksheet for 2024 provides a step-by-step guide to help you determine the amount of tax you owe on your qualified dividends and capital gains.

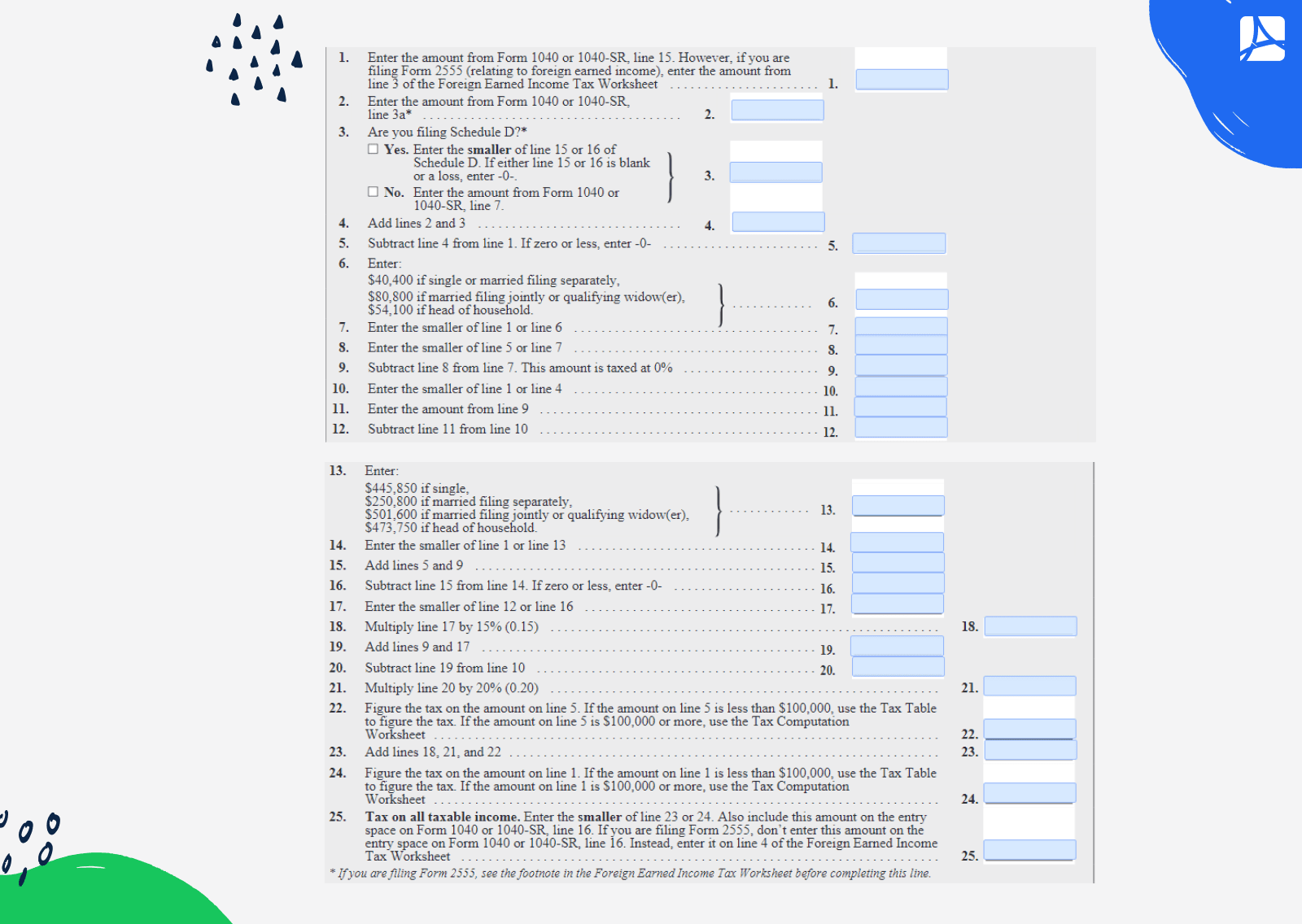

Qualified Dividends and Capital Gain Tax Worksheet 2024

The worksheet starts by calculating your total capital gains and qualified dividends for the year. You then determine your taxable income and apply the appropriate tax rates based on your filing status and income bracket. The worksheet walks you through the process of applying any eligible deductions and credits to reduce your tax liability.

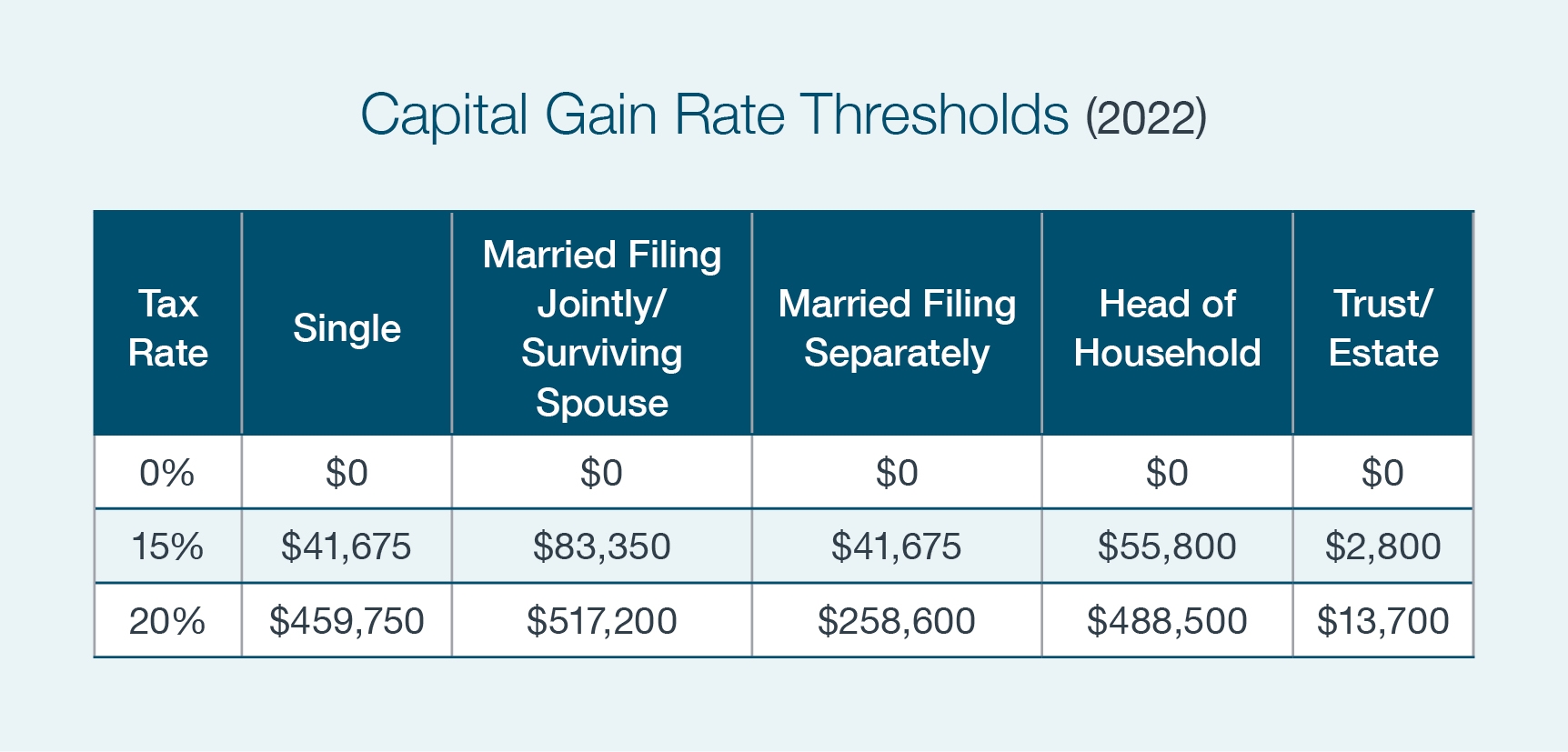

One key benefit of qualified dividends and capital gains is the preferential tax treatment they receive. For most taxpayers, the tax rate on qualified dividends and long-term capital gains is lower than the rate on ordinary income. This can result in significant tax savings for investors who hold assets for the long term.

However, it’s important to note that not all dividends and capital gains qualify for this lower tax rate. To be considered qualified, dividends must meet certain criteria, such as being paid by a U.S. corporation or a qualified foreign corporation. Similarly, capital gains must be from the sale of assets held for more than one year to qualify for the lower tax rate.

As you prepare your taxes for 2024, be sure to carefully review the Qualified Dividends and Capital Gain Tax Worksheet to ensure you are accurately reporting your investment income. Consulting with a tax professional or financial advisor can also help you navigate the complexities of the tax code and maximize your tax savings.

In conclusion, understanding the rules and guidelines for qualified dividends and capital gains can help you make informed investment decisions and minimize your tax liability. By utilizing the Qualified Dividends and Capital Gain Tax Worksheet for 2024, you can ensure that you are complying with the latest tax laws and taking advantage of the preferential tax treatment available for these types of income.